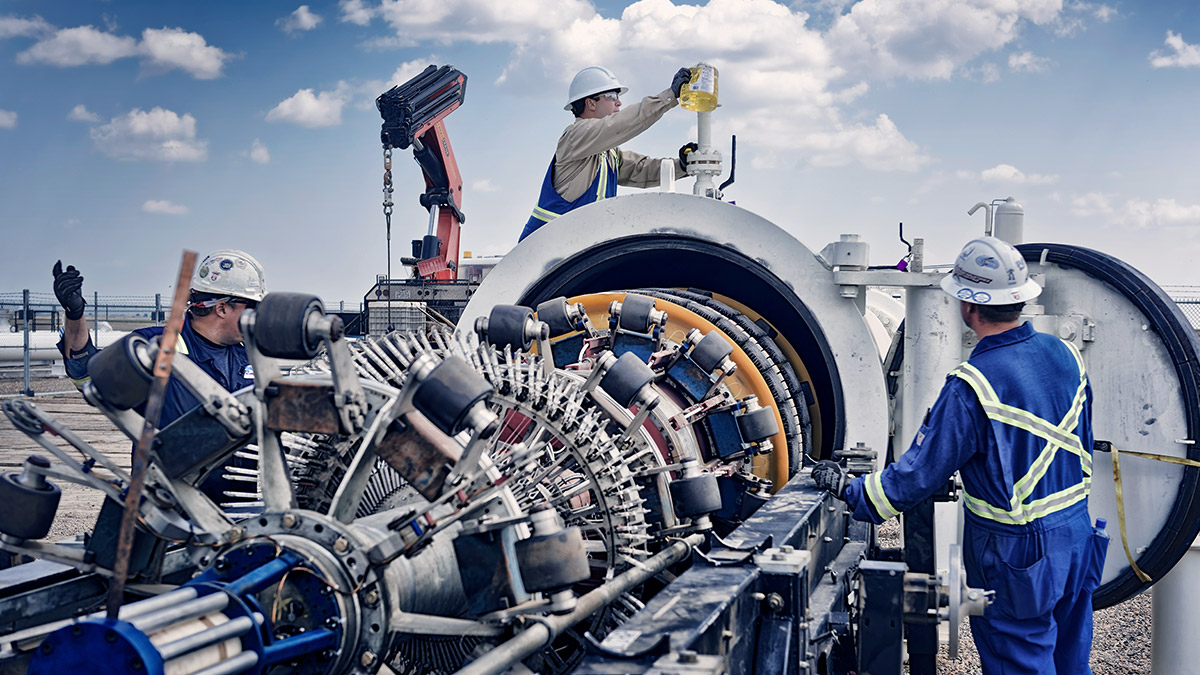

Europe Pipeline Pigging market size was USD 2450 million in 2023 and the market is projected to reach roughly USD 3800 million by 2032, at a CAGR of 5% during the forecast period.

The European pipeline-pigging services market is experiencing robust growth, fueled by several key factors. The region’s extensive network of oil and gas pipelines necessitates ongoing maintenance and inspection, driving an increased demand for pipeline pigging services. Major oil and gas firms are progressively investing in these services to enhance pipeline safety and efficiency, resulting in a proliferation of service providers in the market.

Key drivers of demand for pipeline pigging services include regulatory compliance, aging pipeline infrastructure, the expansion and construction of new pipelines, and the imperative to optimize pipeline performance while minimizing downtime. The market features a diverse landscape comprising large multinational corporations, specialized pigging service providers, engineering firms, and equipment manufacturers. These companies offer a comprehensive suite of pigging services, including cleaning, inspection, maintenance, and the rental and sale of pigging equipment. Additionally, some providers deliver customized pigging solutions designed to meet the unique requirements of specific pipeline systems.

Europe Pipeline Pigging Market report scope and segmentation.

| Report Attribute | Details |

| Base Year | 2023 |

| Forecast Years | 2024 – 2032 |

| Estimated Market Value (2023) | USD 2450 Million |

| Projected Market Value (2032) | USD 3800 Million |

| Segments Covered | By Services, By Application, By Distribution Channel, & By Region. |

| Forecast Units | Value (USD Million or Billion) |

| Quantitative Units | Revenue in USD million/billion and CAGR from 2024 to 2032. |

| Regions Covered | Western Europe, Eastern Europe, Northern Europe, Southern Europe, and Central Europe. |

| Countries Covered | Belgium, France, Germany, Romania, Russia, Ukraine, United Kingdom, Finland, Iceland, Greece, Spain, Italy, Germany, Poland, and Switzerland. |

Europe Pipeline Pigging Market dynamics

With ongoing exploration, manufacturing, and transportation operations, the oil and gas sector remains a significant industry in Europe. The demand for pipeline pigging services is rising as new pipelines are constructed and existing ones are expanded to satisfy the increasing energy needs. Pigging is essential for maintaining cleanliness, ensuring smooth flow, and identifying potential issues within pipelines. As companies invest in the preservation and enhancement of their current pipeline infrastructure, the oil and gas industry is experiencing growth, particularly in regions such as the North Sea and Eastern Europe.

Click Here To Get Complete Access: https://organicmarketresearch.com/europe-pipeline-pigging-market

Europe Pipeline Pigging Market drivers

Growing adoption of advanced pigging technologies

The escalating demand for water pipelines, driven by market growth, necessitates regular cleaning to prevent contamination and ensure safe water delivery. OKFT Ltd, in partnership with the University of Szeged, has developed a novel gel cleaning solution composed of food-grade ingredients. This innovative gel effectively dissolves and evaporates after cleaning, making it ideal for various applications, including municipal and industrial water pipelines, district heating systems, and even gas pipelines. The gel’s unique properties also enable it to rescue traditional cleaning pigs that become stuck during the cleaning process. As the market for water pipeline cleaning continues to expand, gel pigging is emerging as a preferred solution due to its effectiveness and versatility.

Opportunities:

The growing demand for efficient and reliable oil and gas transportation solutions across Europe is a key driver of market growth, as pipeline pigging is essential for maintaining the integrity and optimal performance of these critical infrastructures. An increasing emphasis on pipeline maintenance and inspection, spurred by stringent regulatory requirements and the need for safe energy transportation, further propels market expansion. Additionally, technological advancements in pigging tools and techniques—such as smart pigs equipped with advanced sensors and real-time data transmission capabilities—are enhancing the accuracy and efficiency of inspection processes, thus driving demand. The trend toward rehabilitating and upgrading aging pipeline infrastructure to comply with modern safety and environmental standards presents significant opportunities in the market. Furthermore, the European Union’s commitment to reducing greenhouse gas emissions and transitioning to cleaner energy sources is fostering investment in advanced pipeline technologies.

Challenges

The high costs associated with advanced pigging technologies and equipment can place significant strain on budgets, particularly for smaller operators and maintenance projects. The complexity involved in deploying and operating sophisticated inspection tools, such as smart pigs equipped with advanced sensors and data analysis capabilities, necessitates specialized knowledge and training, which further increases operational expenses. Additionally, navigating regulatory compliance is challenging, as the stringent environmental and safety regulations across various European countries require rigorous—and often costly—adherence. The aging pipeline infrastructure adds another layer of difficulty, as older pipelines may necessitate extensive modifications or replacements to support modern pigging techniques and ensure safety. Technical challenges related to the geometry and condition of pipelines can complicate pigging operations, especially in systems with complex configurations or significant damage.

Segment Overview

By Services, the market is segmented into Pigging and Intelligent Pigging. The pigging segment has emerged as the leader in Europe’s Pipeline Pigging market. Intelligent pigging services are projected to achieve the fastest CAGR during the forecast period, driven by the increasing demand for energy transportation infrastructure and stringent regulations requiring pipeline integrity management. Additionally, the surge in exploration and production activities in remote and challenging terrains has created a need for advanced inspection techniques, such as intelligent pigging. A key factor propelling the adoption of intelligent pigging is its capability to deliver accurate, real-time data, which facilitates proactive maintenance and mitigates the risk of catastrophic failures. Furthermore, the integration of cutting-edge technologies like robotics, artificial intelligence, and data analytics significantly enhances the efficiency and effectiveness of pipeline inspections, ultimately reducing downtime and operational costs for asset owners.

By Application, The Europe Pipeline Pigging Market is segmented into Metal Loss/Corrosion Detection, Crack & Leakage Detection, Geometry Measurement & Bend Detection, and Other. The market has been dominated by the metal loss/corrosion detection segment, while the crack & leakage detection sector is expected to develop at the quickest CAGR over the forecast period. Numerous factors that propel the need for metal loss and corrosion detection services in the pipeline pigging market have led to the dominance of the metal loss/corrosion detection sector. To ensure compliance and reduce the danger of accidents or environmental incidents, pipelines must be regularly inspected and maintained in accordance with strict rules and safety requirements. The aging pipeline infrastructure emphasizes even more the need it is to conduct thorough inspections and monitoring in order to quickly address corrosion and metal loss issues. Additionally, in order to preserve the integrity and dependability of the infrastructure, improved inspection technologies are required due to the growing complexity and size of pipeline networks as well as the expansion of activities into distant or difficult regions. As a result, it is anticipated that the market will continue to rise in need of metal loss & corrosion detection services, with service providers concentrating on creating and implementing cutting-edge technologies to satisfy changing customer demands and maintain pipeline networks’ dependability and safety.

Europe Pipeline Pigging Market Overview by Region

The UK is at the forefront of the Pipeline Pigging market in Europe, driven by several key factors. The region’s extensive network of oil and gas pipelines necessitates regular maintenance and inspection, leading to increased demand for pipeline pigging services. Major oil and gas companies are increasingly investing in these services to enhance pipeline safety and operational efficiency, resulting in a growing number of service providers in the market. One notable player is Pigtek, a UK-based company which specializes in providing pipeline cleaning pigs, pigging services, and ancillary equipment. As an independent, privately owned entity, Pigtek is committed to delivering customized solutions tailored to specific applications within the international oil and gas sector.

Europe Pipeline Pigging market competitive landscape

Key players in the Europe Pipeline Pigging market are Baker Hughes Company, Pigtek Ltd, Dexon Technology PLC, Applus+, LIN SCAN, ROSEN Group, MISTRAS Group, T.D. Williamson, Inc., PipeSurvey International, Penspen Limited.

Europe Pipeline Pigging report market segmentation

| ATTRIBUTE | DETAILS |

| By Services | Pigging Intelligent Pigging |

| By End-Use | OilGas |

| By Application | Metal Loss/Corrosion DetectionCrack & Leakage DetectionGeometry Measurement & Bend DetectionOther |

| By Distribution Channel | Specialty storesOnline retailOthers |

| Customization Scope | Available upon request |

| Pricing | Available upon request |

Frequently Asked Questions (FAQ)

Q- What is the study period of Europe Pipeline Pigging Market report?

A- Europe Pipeline Pigging market forecast period is 2024 – 2032.

Q- What is the expected Europe Pipeline Pigging market growth rate during the forecast period?

A- According to Europe Pipeline Pigging research, the market is expected to grow at a CAGR of ~ 5% over the next eight years.

Q- What is the expected market size for Europe Pipeline Pigging market?

A- The expected market size for Europe Pipeline Pigging is USD 3800 million in 2032.

Q- What are the possible segments in Europe Pipeline Pigging Market?

A- The possible segments in Europe Pipeline Pigging market are based on By Services, By Application, By End Use, By Distribution Channel, and By Region.

Q- Who are the major players in Europe Pipeline Pigging Market?

A- The major players in the market are Baker Hughes Company, Pigtek Ltd, Dexon Technology PLC, Applus+, LIN SCAN, ROSEN Group, MISTRAS Group, T.D. Williamson, Inc., PipeSurvey International, Penspen Limited.